- Mortgage calculator extra payment 2 weeks later full#

- Mortgage calculator extra payment 2 weeks later series#

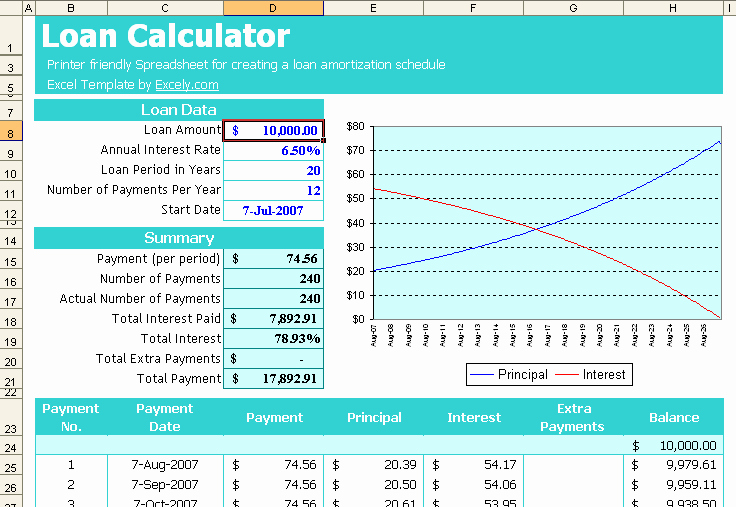

Your loan’s principal, fees, and any interest will be split into payments over the course of the loan’s repayment term.

Mortgage calculator extra payment 2 weeks later full#

This results in savings of 122,306 in interest. Another way to pay down your mortgage in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment.

Biweekly payments mean you pay off your loan 4 years and 3 months early by making the equivalent of one extra payment per year. By paying extra 500.00 per month starting now, the loan will be paid off in 17 years and 3 months. We’ll take a look at it from both a monthly and biweekly payment perspective. NOTE: The calculator will not recognize overlapping payments of the same frequency. Repayment term: The repayment term of a loan is the number of months or years it will take for you to pay off your loan. Say your loan is 200,000 on a 30-year fixed-rate mortgage with a 4.125 interest rate. If additional payments are made, interest savings and reduction in length of loan are calculated.You can use Bankrate’s APR calculator to get a sense of how your APR may impact your monthly payments. APR: The APR on your loan is the annual percentage rate, or cost per year to borrow, which includes interest and other fees.This rate is charged on the principal amount you borrow. Interest rate: An interest rate is the cost you are charged for borrowing money.If you pay 100 extra each month towards principal, you can cut your loan term by more than 4.5 years and reduce the interest paid by more than 26,500. When taking out any loan, it’s important to understand these four factors: If you make your regular payments, your monthly mortgage principal and interest payment will be 955 for the life of the loan, for a total of 343,739 (of which 143,739 is interest).

Common types of unsecured loans include credit cards and student loans. Unsecured loans don’t require collateral, though failure to pay them may result in a poor credit score or the borrower being sent to a collections agency. Have a play with our extra loan repayments calculator if you are thinking about making additional payments to your home loan to see how it could benefit. In exchange, the rates and terms are usually more competitive than for unsecured loans. Common examples of secured loans include mortgages and auto loans, which enable the lender to foreclose on your property in the event of non-payment. With this in mind, you should only use this calculator to get an indication of how making extra repayments will affect your home loan.Secured loans require an asset as collateral while unsecured loans do not. Depending on the type of home loan you get and how your circumstances change over the years, the time and money you save making extra repayments may be significantly different from the answer you get here. Keep in mind a calculator can't give you a precise result because of the amount of variance between financial lenders and their home loan products.

Mortgage calculator extra payment 2 weeks later series#

This extra loan repayments calculator provides you with an estimate based on the details you input and a series of assumptions, including: Total interest saved by making extra repayments. Use the home loan repayment calculator from Mortgage Choice to work out how long it will take to pay off your mortgage.Total time saved by making extra repayments.Your total home loan repayment, including extra contributions. By making payments every two weeks you actually end up paying more per year (the equivalent of one extra monthly payment).Your results will generate automatically when you enter your details into the calculator. The earlier you start making these repayments, the more time and money you will save with your home loan. Use the loan balance chart to get a visual of how making extra repayments affects your mortgage. Simply enter the details of your home loan, as well as how much your extra repayments will be and after how many years you will start making them. The extra repayment calculator works like the mortgage payment calculator, except that it will also take into account regular principal-only repayments. How does the extra repayments calculator work? If you had a 400,000 loan amount set at 4 on a 30-year fixed, paying an extra 100 per month would save you nearly 30,000 and youd pay off your loan two.

0 kommentar(er)

0 kommentar(er)